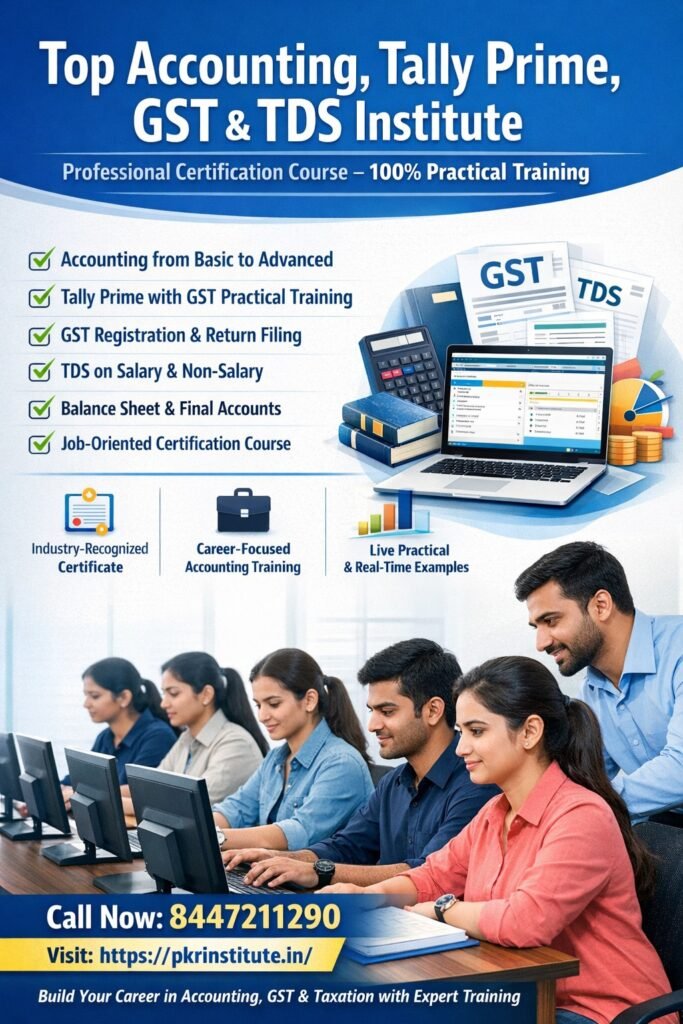

In today’s competitive job market, professional accounting skills are in high demand. Companies across industries require trained accountants who have strong practical knowledge of Accounting, Tally Prime, GST, and TDS. Choosing the right institute with a recognized certification course plays a vital role in building a successful career in accounts, finance, and taxation.

This article explains why enrolling in a professional accounting course is important and how to identify the top 5 accounting, Tally Prime, GST, and TDS institutes with certification courses that can help you achieve your career goals.

Why Choose an Accounting Course with Tally Prime, GST & TDS?

Accounting is no longer limited to manual bookkeeping. Modern businesses rely on accounting software and tax compliance systems. A professional course that includes Tally Prime, GST, and TDS provides industry-ready skills.

Key Benefits:

- Practical knowledge of accounting software

- Understanding of GST returns, filing, and compliance

- TDS calculation, deduction, and return filing

- Job-oriented training with real-time projects

- Industry-recognized certification

A well-structured certification course improves employability and opens doors to roles like Accounts Executive, GST Consultant, Tally Operator, and Finance Assistant.

What Makes a Top Accounting Institute?

Before selecting from the top accounting institutes, you should evaluate the following factors:

1. Comprehensive Course Curriculum

A good institute offers complete coverage of:

- Basic to advanced accounting

- Tally Prime with GST

- GST registration, returns, and compliance

- TDS on salary and other payments

- Income Tax basics

2. Practical Training

Institutes that provide live projects, case studies, and practical assignments prepare students for real-world accounting challenges.

3. Experienced Faculty

Qualified trainers with industry experience ensure better understanding and career guidance.

4. Certification

A recognized certification adds credibility to your profile and boosts job prospects.

5. Placement Assistance

Top institutes provide interview preparation, resume building, and placement support.

Top 5 Accounting, Tally Prime, GST & TDS Institutes with Certification Courses

Below are the key features you should expect when choosing from the top 5 accounting institutes offering professional certification courses:

1. Advanced Accounting Training

Top institutes focus on fundamentals such as:

- Accounting principles

- Journal entries

- Ledger and trial balance

- Final accounts and balance sheet preparation

This strong foundation helps students understand both manual and computerized accounting systems.

2. Tally Prime with GST Integration

Tally Prime is widely used by businesses in India. Leading institutes offer:

- Company creation and configuration

- Inventory management

- GST setup in Tally

- GST returns (GSTR-1, GSTR-3B)

- Compliance and reporting

Hands-on practice in Tally Prime is a must-have feature of top institutes.

3. GST Practical Training

GST is a core requirement for accountants. Top institutes cover:

- GST registration process

- Input tax credit (ITC)

- GST return filing

- Compliance rules and deadlines

- Practical GST case studies

This training enables students to handle GST work independently for businesses.

4. TDS Course with Real-Time Application

A professional accounting course must include:

- TDS on salary and non-salary payments

- TDS rates and sections

- TDS calculation and deduction

- TDS return filing

- TDS compliance and penalties

Institutes that provide practical TDS training help students become job-ready quickly.

5. Certification and Career Support

Top institutes provide:

- Course completion certificates

- Industry-recognized credentials

- Resume preparation support

- Interview training

- Job placement assistance

Certification validates your skills and increases trust among employers.

Who Should Join These Accounting Certification Courses?

These courses are suitable for:

- Commerce students (B.Com, M.Com)

- Graduates and postgraduates

- Working professionals

- Business owners

- Job seekers in accounting and finance

- Anyone looking to start a career in taxation

Even beginners can join, as most institutes start from basics and move towards advanced practical training.

Career Opportunities After Completing the Course

After completing a certification course from a top accounting institute, you can apply for roles such as:

- Accounts Executive

- Tally Operator

- GST Consultant

- TDS Executive

- Junior Accountant

- Finance Assistant

You can also start your own accounting or GST consultancy practice.

Conclusion

Choosing the right institute from the top 5 accounting, Tally Prime, GST, and TDS institutes with certification courses is a smart investment in your future. A well-designed course with practical exposure, experienced faculty, and recognized certification can significantly improve your career prospects.

If you are serious about building a successful career in accounting and taxation, select an institute that offers complete practical training, Tally Prime expertise, GST and TDS knowledge, and certification support. With the right skills and guidance, you can achieve long-term professional growth in the accounting field.