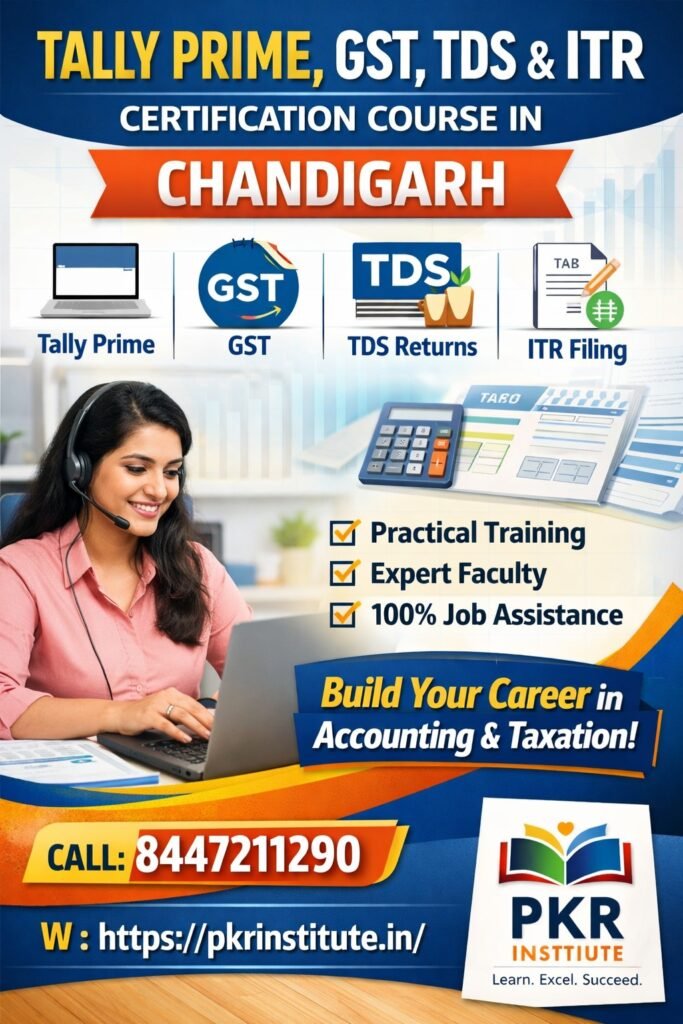

In today’s competitive job market, practical accounting skills are more valuable than ever. With businesses focusing on compliance, taxation, and accurate financial reporting, trained accounting professionals are in high demand. Enrolling in a Tally Prime, GST, TDS Returns & ITR Certification Course in Chandigarh can open the door to numerous career opportunities in finance, accounting, and taxation.

Chandigarh, known for its quality education and professional training institutes, has emerged as a preferred destination for students and working professionals seeking skill-based accounting courses. This certification course is designed to provide hands-on knowledge of modern accounting tools and statutory compliance, making candidates job-ready from day one.

Importance of Tally Prime in Modern Accounting

Tally Prime is one of the most widely used accounting software solutions in India and across the globe. It is trusted by small businesses, large enterprises, chartered accountants, and tax consultants for managing day-to-day financial operations.

A professional course in Tally Prime covers essential accounting functions such as ledger creation, voucher entries, inventory management, payroll processing, banking transactions, and financial statements. The Tally Prime Certification Course in Chandigarh focuses on practical training, allowing learners to work on real-time business scenarios.

With companies increasingly adopting digital accounting systems, proficiency in Tally Prime significantly improves employability. Whether you aspire to work as an accountant, accounts executive, or finance assistant, Tally Prime skills are indispensable.

GST Training: A Mandatory Skill for Accountants

Since the introduction of Goods and Services Tax, GST compliance has become a crucial part of every business operation. Understanding GST laws, filing returns, and maintaining accurate records is essential for avoiding penalties and ensuring smooth business functioning.

A comprehensive GST Certification Course in Chandigarh provides in-depth knowledge of GST concepts such as registration, invoice formats, input tax credit, reverse charge mechanism, and GST compliance. Students also learn how to file various GST returns including GSTR-1, GSTR-3B, GSTR-2A reconciliation, and annual returns.

Practical GST training combined with Tally Prime integration helps learners understand how GST works in real business environments. This skill set is highly valued by employers and tax consultants.

TDS Returns: Enhancing Professional Expertise

Tax Deducted at Source (TDS) is another critical area in Indian taxation. Every organization is required to deduct and deposit TDS as per income tax regulations. A detailed understanding of TDS provisions is essential for accounting and payroll professionals.

The TDS Returns Certification Course in Chandigarh trains students in TDS calculation, challan generation, and return filing using Form 24Q, 26Q, and 27Q. Learners also gain clarity on TDS sections, rates, deadlines, and penalties for non-compliance.

By mastering TDS returns, candidates become capable of handling complete taxation responsibilities within an organization, making them more valuable in the job market.

ITR Filing and Income Tax Return Certification

Income Tax Return (ITR) filing is an essential function for individuals, professionals, and businesses. With changing income tax laws and increasing scrutiny, certified professionals are needed to ensure accurate and timely ITR filing.

An ITR Certification Course in Chandigarh equips students with knowledge of different ITR forms, deductions, exemptions, capital gains, and tax planning. The course covers filing returns for salaried individuals, freelancers, partnership firms, and companies.

Hands-on training in ITR filing helps learners confidently assist clients or manage tax compliance for organizations. This certification is particularly beneficial for those planning to work as tax consultants or start their own practice.

Why Choose Chandigarh for Accounting Certification Courses?

Chandigarh offers a perfect blend of quality education, professional exposure, and affordable training options. Institutes providing Tally Prime, GST, TDS Returns & ITR Certification Course in Chandigarh focus on industry-oriented curriculum and practical learning.

Key advantages of studying in Chandigarh include:

- Experienced and industry-trained faculty

- Practical, software-based training

- Live projects and real-time case studies

- Placement assistance and career guidance

- Affordable course fees compared to metro cities

These courses are suitable for commerce students, graduates, working professionals, entrepreneurs, and even beginners who want to build a career in accounting and taxation.

Career Opportunities After Certification

After completing a Tally Prime, GST, TDS Returns & ITR Certification Course in Chandigarh, candidates can explore multiple career paths such as:

- Accounts Executive

- GST Consultant

- Tax Analyst

- TDS Executive

- Junior Accountant

- Finance Assistant

- Freelance Tax Consultant

With experience, professionals can also start their own accounting or taxation consultancy, offering services to small and medium businesses.

Conclusion

The demand for skilled accounting professionals continues to grow as businesses emphasize financial transparency and legal compliance. A professional Tally Prime, GST, TDS Returns & ITR Certification Course in Chandigarh provides the perfect foundation for a successful career in accounting and taxation.

By gaining practical exposure to Tally Prime, GST filing, TDS returns, and ITR certification, students become industry-ready and capable of handling real-world accounting challenges. Whether you are a student or a working professional, investing in this certification course is a smart step toward long-term career growth and financial stability.