The Goods and Services Tax (GST) is one of the most significant tax reforms in modern India. Introduced to streamline the indirect taxation system, GST replaced multiple taxes like excise duty, service tax, VAT, and luxury tax with a single, comprehensive tax structure. In 2026, GST remains a cornerstone of India’s taxation policy, facilitating seamless trade, enhancing compliance, and promoting economic growth. Understanding the fundamentals of GST is crucial for businesses, professionals, and students of commerce.

1. Introduction to GST

GST is a destination-based consumption tax levied on the supply of goods and services. Unlike traditional taxes that were imposed at multiple stages, GST integrates various indirect taxes into a single framework. This tax is administered jointly by the Central Government (CGST) and the State Governments (SGST) for intra-state transactions, while Integrated GST (IGST) is applied on inter-state transactions.

The primary objectives of GST are:

- To create a unified national market by eliminating the cascading effect of taxes.

- To simplify tax compliance for businesses.

- To increase tax revenue for the government by broadening the tax base.

- To ensure transparency in indirect taxation and reduce tax evasion.

2. Structure of GST

GST operates under a dual structure:

- Central GST (CGST): Collected by the Central Government on intra-state supplies.

- State GST (SGST): Collected by the State Governments on intra-state supplies.

- Integrated GST (IGST): Collected by the Central Government on inter-state supplies and imports.

This dual structure ensures that both the central and state governments share the revenue from transactions occurring within a state while maintaining a consistent framework for inter-state trade.

Key Components:

- CGST and SGST: For transactions within the same state.

- IGST: For transactions between two states or across borders.

- UTGST: Applies to Union Territories without legislatures, like Lakshadweep and Chandigarh.

3. Taxable Event in GST

The taxable event in GST is the “supply” of goods or services. Supply includes sale, transfer, barter, lease, or exchange. It can be categorized as:

- Supply of goods – Manufacturing and selling products.

- Supply of services – Providing services like consulting, legal advice, or software services.

GST is levied only if the supply is taxable and the transaction exceeds the threshold limit set by the government.

4. GST Rates

GST is levied at different rates depending on the category of goods or services. The GST Council has classified goods and services into multiple tax slabs, making it flexible and fair. Typical rates include:

- 0% GST: Essential items like fresh food, milk, and healthcare products.

- 5% GST: Common necessities and small-scale goods.

- 18%, and 40% GST: Higher-value goods, luxury items, and services.

These rates ensure that necessities are affordable while luxury and non-essential items contribute more to revenue.

5. Registration under GST

Businesses are required to register for GST if their turnover exceeds the prescribed limits:

- Goods suppliers: ₹40 lakh in most states; ₹20 lakh for special category states.

- Service providers: ₹20 lakh in most states; ₹10 lakh for special category states.

Registration ensures that businesses can collect GST from customers, claim input tax credit, and comply with GST regulations.

6. Input Tax Credit (ITC)

One of the most important features of GST is Input Tax Credit (ITC). It allows businesses to deduct the tax paid on purchases from the tax payable on sales. ITC helps in:

- Reducing the cascading effect of taxes.

- Encouraging compliance among businesses.

- Improving cash flow and reducing operational costs.

To claim ITC, businesses must maintain proper invoices, bills, and returns as prescribed under GST law.

7. GST Returns

Compliance under GST requires filing regular returns. Returns summarize sales, purchases, tax collected, and ITC claimed. Some commonly used GST returns include:

- GSTR-1: Details of outward supplies (sales).

- GSTR-3B: Monthly summary return for tax payment.

- GSTR-9: Annual return summarizing all transactions.

Timely and accurate return filing is crucial to avoid penalties and interest charges.

8. Advantages of GST

GST offers numerous benefits to businesses, consumers, and the economy:

- Simplification of Taxation: GST replaces multiple taxes with a single system.

- Reduction of Tax Cascading: ITC prevents double taxation on goods and services.

- Boost to “Make in India”: Uniform tax rates make manufacturing in India more competitive.

- Increased Revenue: Better compliance and wider tax base increase government revenue.

- Ease of Doing Business: GST makes trade transparent and reduces compliance burden.

9. Challenges under GST

Despite its advantages, GST implementation poses certain challenges:

- Complexity in Compliance: Multiple returns, rates, and rules can confuse small businesses.

- Frequent Amendments: Businesses must stay updated with changing laws.

- Technology Dependency: Filing and invoicing require internet and digital tools.

To overcome these challenges, businesses often rely on GST software, professional accountants, and regular training.

10. GST in 2026: Key Updates

By 2026, GST has evolved further:

- Digital-first approach: E-invoicing and automated reconciliation are standard.

- Expanded compliance tools: Real-time reporting and analytics for businesses.

- Sector-specific reforms: Tax rates have been optimized for sectors like e-commerce, healthcare, and education.

- Global trade alignment: IGST rules have been refined for cross-border transactions.

These updates make GST more efficient, transparent, and business-friendly, supporting India’s vision of a digital economy.

11. Conclusion

The Goods and Services Tax (GST) has transformed India’s taxation system into a simplified, transparent, and unified framework. By understanding its fundamentals—structure, registration, ITC, rates, and compliance—businesses can optimize tax management and ensure regulatory adherence. As India continues to modernize its economy, staying updated with GST rules and reforms is essential for financial planning and strategic growth.

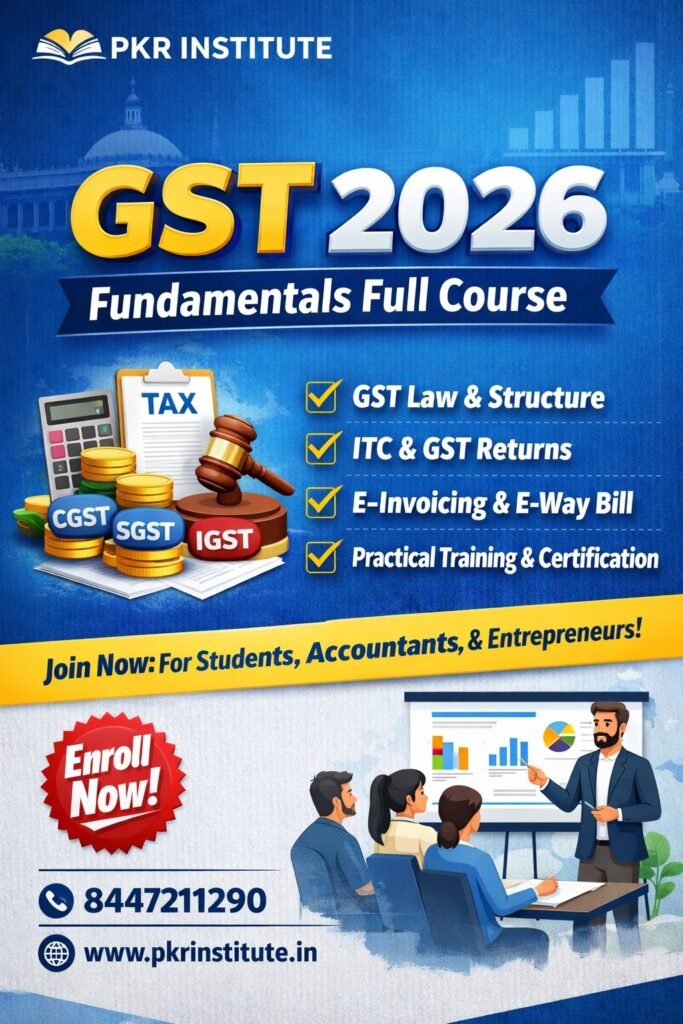

A full course on GST in 2026 equips learners with practical knowledge of tax computation, filing returns, claiming ITC, and understanding legal provisions—making it invaluable for entrepreneurs, accountants, finance professionals, and students alike.